Investment Philosophy

Are you tired of hearing your advisor tell you to “stay the course, to be patient, or that you’ll do well over the long term?” Have you ever felt that there must be a better way? Well there is.

IMAGINE… your financial advisor is only working with 25 or so clients, you being one of them. IMAGINE the attention you and your portfolio would get. Do you think the added attention would positively impact your investment returns? The REALITY is that most advisors have hundreds of client. If your advisor is helping 300 households, at 2 clients per household, with 3 accounts each (example: non-registered, RRSP, TFSA), that works out to 1,800 investment accounts to monitor. Even if your advisor did nothing but work on investments all day, how often could they really provide you with specific, relevant and timely advice on your portfolio? If your advisor knew there was a correction coming, for most advisors, the rules state that they must get approval to make investment changes to your portfolio. So at 1 hour per call to each household, working 8 hours per day, the REALITY is that it would take over a month for your advisor to call all their clients. By this time it may be too late and the correction may have already occurred. This is one of the reasons advisors tell their clients to buy a portfolio of investments, and simply rebalance that portfolio once in a while. But think about it: does a pension plan call pensioners before making investment changes? Or do they simply do what is best for their members? Don’t you deserve the same?

IMAGINE that your advisory team has their clients invested based on risk tolerance so that all conservative clients have the same portfolio, all medium risk clients have the same portfolio, and all aggressive clients had the same portfolio. Further imagine that your advisory teams has a dedicated portfolio manager assigned to watch market indicators to make timely portfolio changes on a discretionary basis. Discretionary means that the portfolio manager can make changes to the portfolio while the opportunity is there, and report those changes to you after the fact so that you don’t miss out on that opportunity. So instead of just “staying the course” (and possibly driving off a market cliff), this means reducing equity (stocks) in the portfolio when markets are high or possibly even going to cash. When’s the last time your advisor recommended that you go to cash? When markets are low, it means ramping up on equity. This is more easily managed because when a change is made for conservative clients, the change happens for all conservative clients. When a change is made for moderate clients, it’s made for all moderate clients. When an investment mandate is no longer in favor, it means selling that investment and getting into a new product with a different mandate. But it doesn’t end there.

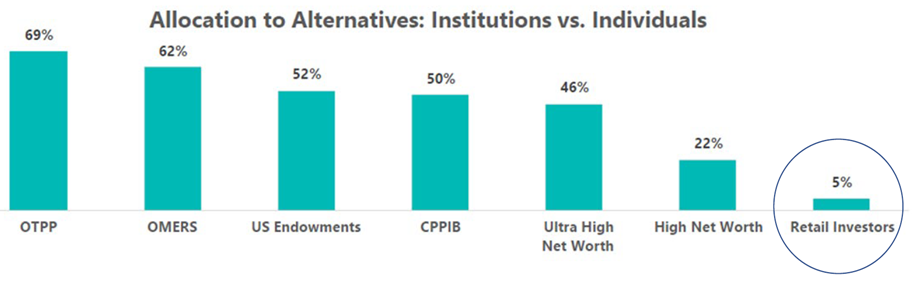

INVESTING LIKE A PENSION PLAN means more than having discretionary management over your portfolio. It’s also about product selection. Multi-million dollar pension plans have access to more investment products than the average investor. They invest in stocks, bonds, mutual funds, ETFs and are not limited to just one type or brand of investments. Of particular importance, pension plans have access to private alternative investments. Some pension plans have up to 69% in alternative investments, which include private debt and private real estate. Even the Canada Pension Plan has about half of it’s investments in private alternatives (see chart below). So why isn’t everyone investing in private alternatives like pension plans? Because you need to be an accredited investor for these types of investments. There are several criteria to be considered an accredited investor, but one of them is having over $1 million in investable assets. This is a problem for many investors as they don’t meet the criteria.

IMAGINATION BECOMES REALITY… Now you can invest like a pension plan though Watermark Private Portfolios, a unified management account with the following features:

- Discretionary portfolio management.

- Access to private alternative investments.

- Ability to have access to pools managed by multiple product managers all consolidated in one account.

- Ability to go to cash, increase or decrease equity content based on market conditions.

- World Class Reporting – Comprehensive investment report which includes market commentaries, investment performance, performance attribution, portfolio activity with activity rationale.

- Householding – Simplify your portfolio reporting by including all family accounts as well as corporations, trusts, etc. into one quarterly report.

- Management fees in non-registered accounts are tax deductible.

This has yielded great results for clients since the inception of the program. Call me for details.

How is this different from a traditional portfolio fund?

- Most portfolio solutions have a very limited ability to go to cash.

- Most portfolio solutions have investments from the same manufacturer instead of picking the best products from various manufacturers.

- Most portfolio solutions stick to mutual funds and don’t include ETFs or individual stocks.

- Most portfolio solutions do not include private alternative products.

- Most portfolio solutions do not tactically change allocation based on economic conditions, and simply rebalance from time to time (the old way of doing things).

Backed by one of Canada’s premier independent firms, Prestige Private Wealth Management is about bold new ways of managing your wealth. It’s about the ability to make good decisions, so that you can make the most of your money. It’s designed so that you can worry less, and enjoy more. It’s about seizing opportunities while they last, and being cautious when it’s necessary. We’re here to make money easy, to make good decisions that lead to exceptional opportunities, and to help you simplify and achieve your financial dreams.

Other custom portfolio options available. Chart source: Frontier Investment Management-Investing Like the Harvard & Yale Endowment Funds

Get In Touch

If you are interested in learning more, have any questions or want to work with us then please drop us a line, we would love to hear from you.