PRESTIGE PRIVATE WEALTH:

Investment Philosophy

Are you tired of hearing your advisor tell you to “stay the course, to be patient, or that you’ll do well over the long term?” Have you ever wondered if there must be a better way? There is.

Imagine this:

Your financial advisor is only working with 25 or so clients — and you are one of them. IMAGINE the level of attention you and your portfolio would receive. Do you think that added attention could positively impact your investment outcomes?

The REALITY is that most advisors serve hundreds of households. If an advisor helps 300 households, averaging 2 clients per household with 3 accounts each (e.g., non-registered, RRSP, TFSA), that’s 1,800 accounts to monitor. Even if your advisor spent every hour of the day on investments, how often could they provide truly timely, tailored advice? If a market correction loomed, compliance rules would still require household-by-household calls for approvals. At one hour per call, it could take over a month to reach everyone — often too late. This is why many advisors default to “buy and hold” portfolios, rebalanced only occasionally. But consider: do pension plans call every pensioner before adjusting investments? Or do they simply act in the members’ best interests? Don’t you deserve the same?

Imagine again:

Your advisory team groups clients by risk profile: conservative, balanced, or growth. Each group follows a disciplined portfolio mandate overseen by a dedicated Portfolio Manager. This manager has the discretion to make timely adjustments based on market conditions, reducing equities when markets peak, or moving to cash if necessary. When markets are low, equities are increased to capture opportunities.

Because changes apply across all clients within a risk category, decisions are executed swiftly — ensuring no one misses opportunities while avoiding unnecessary delays.

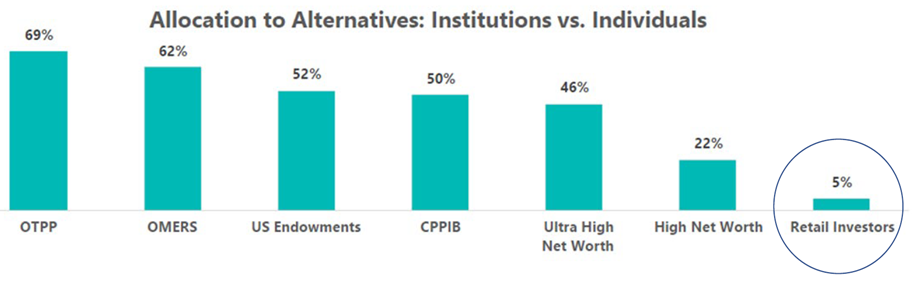

*Chart source: Frontier Investment Management – Investing Like the Harvard & Yale Endowment Funds.

Imagination becomes reality:

Now you can invest like a pension plan through Watermark Private Portfolios,

a unified management account with the following features:

- Discretionary portfolio management.

- Access to private alternative investments.

- Ability to invest in pools managed by multiple product managers, consolidated in one account.

- Flexibility to move to cash, or adjust equity exposure based on market conditions.

- High-standard reporting – Comprehensive investment reports including market commentaries, performance, attribution, portfolio activity, and rationale.

- Householding – Consolidated reporting across family accounts, corporations, and trusts in a single quarterly report.

- Management fees in non-registered accounts are tax deductible.

This approach has delivered strong results for clients since inception.

Contact us for details.

How is this different from a traditional portfolio fund?

- Most portfolio solutions have very limited ability to move to cash.

- Most are restricted to products from the same manufacturer, instead of selecting the best across providers.

- Stick to mutual funds and exclude ETFs or individual securities.

- Most do not include private alternative products.

- Most do not tactically adjust allocations based on economic conditions, relying instead on periodic rebalancing (the old way).

Backed by Harbourfront Wealth Management

Prestige Private Wealth Management offers bold new ways of managing your wealth.

It’s about the ability to make sound decisions so you can make the most of your money.

It’s designed to help you worry less and enjoy more — seizing opportunities while they last,

and being cautious when necessary.

We are here to simplify wealth, make informed decisions, unlock exceptional opportunities,

and help you achieve your financial dreams.

Other custom portfolio options available.

Supported by our Custodian NBIN

With over 25 years of continuous service and a team of more than 200 professionals, National Bank Independent Network is Canada’s leading provider of custody, trade execution and brokerage solutions to independent Portfolio Managers and Investment Dealers.

NBIN is custodian for over $180 Billion is assets, over 400 Independent Firms, representing over 600,000 clients.